Senator Elizabeth Warren this week branded Federal Reserve chair Jay Powell a “dangerous man” based on perceived weaknesses in bank regulation. The language was strong but the evidence flimsy: since the 2008 crisis, Fed supervisors have taken a relatively tough approach and US banks boast record capital levels.

If Warren had wanted to go after the institution, a much better line of attack was available. Two regional Fed presidents have just resigned after disclosures about their personal trading activity. The Fed is already vulnerable to the charge that its vast programme of quantitative easing has enriched asset holders more than ordinary salaried workers. The fact central bank officials are not only profiting from sizeable stock portfolios but were also actively trading in securities that are sensitive to rate decisions is offensive.

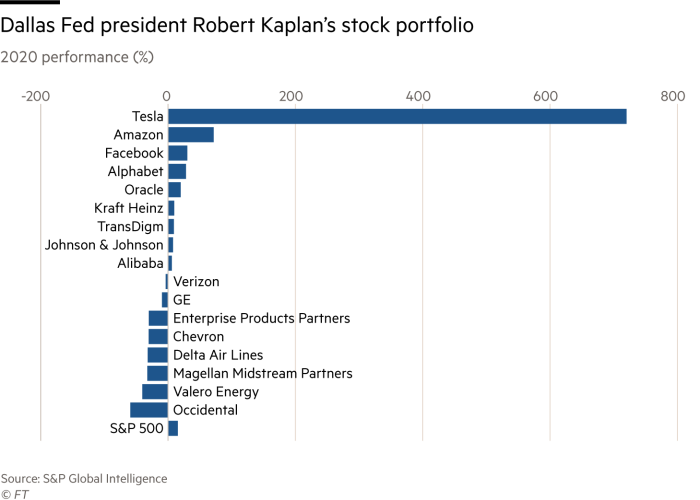

Dallas Fed president Robert Kaplan spent part of last year buying and selling at least $1m of shares in companies from Chinese tech giant Alibaba to US electric car maker Tesla, according to disclosures first highlighted by the Wall Street Journal. His counterpart at the Boston Fed, Eric Rosengren, made smaller transactions in real estate investment trusts and stocks including Chevron and Pfizer. Both resigned this week, with Kaplan citing the distraction of the scrutiny of his trading and Rosengren citing poor health.

Neither seems to have broken any rules but that is part of the problem. The Fed has said it will review its ethics policies, which currently prohibit ownership of bank stocks but allow senior officials to conduct other extensive trading.

This problem is not confined to the Fed. Many members of Congress are active traders. At its worst this has included classic insider trading. Former Republican representative Chris Collins was jailed in 2020 after dumping shares in a pharmaceuticals company whose chief executive had told him about bad clinical trial results. Those who have escaped sanction include lawmakers who sold stock after government briefings about the 2008 financial crisis and the 2020 coronavirus pandemic.

But also worthy of scrutiny are other lawmakers where potential conflicts exist. House Speaker Nancy Pelosi has become a meme among traders after disclosures showed multi-million dollar bets on big tech stocks, apparently made by her husband Paul.

Warren herself looks beyond reproach on this. The senator publishes her tax returns on her website — last year the leftwing firebrand and her husband reported income of $882,322. When she was elected to office in 2012, she owned only a single stock, IBM, which she sold shortly after.

The senator is one of several members of Congress sponsoring legislation to prohibit lawmakers and officials from trading in individual stocks. This should happen. Not only does it remove conflicts of interest, it may have upside for the people involved. When Hank Paulson became Treasury secretary in the Bush administration he sold half a billion dollars of Goldman stock but was allowed to defer capital gains taxes.

More important, it will save officials from themselves. Kaplan’s profit and loss account is not disclosed. He may have expertly traded in and out of his positions. And he certainly owned some 2020 winners led by Tesla, which rose 720 per cent in the year. But the median performer in the Kaplan stock portfolio rose 6 per cent, less than the S&P 500, dragged down by losers such as Occidental Petroleum and Delta Air Lines. The most prominent financial officials in the country are supposed to know that trading individual stocks without inside knowledge is a bad idea.

Whether for appearances or sound financial management, Powell himself appears to get this. He does not seem to be hammering away at a Robinhood account during dull meetings on monetary policy. His own disclosures show no individual stock trading, just investments in a broad range of index funds and municipal bonds. Despite his “dangerous” tag, Powell is playing it safe.

"Trading" - Google News

October 01, 2021 at 05:49PM

https://ift.tt/39RxVp4

Federal Reserve stock trading is dangerous - Financial Times

"Trading" - Google News

https://ift.tt/2tBJjTS

https://ift.tt/3djUFhc

Bagikan Berita Ini

0 Response to "Federal Reserve stock trading is dangerous - Financial Times"

Post a Comment