Trading options in an IRA is possible but has its caveats. For those who qualify, here are some options trading strategy ideas that could open up some possibilities you never thought existed.

Photo by Dan Saelinger

Key Takeaways

Options trading in your IRA? That’s something you don’t hear about every day. Some think it can’t be done. But in a word, yes. You can. Although you may not be able to trade every single options strategy out there, you’re not limited to just one or two. Your choices include options-only strategies that you can use for speculation without owning the stock as well as hedging strategies to use with stocks you own. But depending on the strategy you choose to trade, you’ll need the appropriate level of options trading in the IRA. And, options aren’t appropriate for everyone with an IRA.

One major restriction: you can’t borrow money from an IRA. That may immediately preclude several options strategies. So what can you trade in an IRA? Here are some options strategy dos and don’ts to consider in your IRA.

The No-No List

Let’s start with what you can’t do—which includes selling stock short, selling naked options, or borrowing on margin.

Short selling. When you sell a stock you don’t own, you’re selling it short. The goal is to profit if the stock drops in price. If the stock goes up, short sellers lose money. This strategy isn’t allowed in your IRA, but if you’ve got your heart set on it, see the sidebar “Can’t Short Stock in an IRA?” for another possibility.

Selling naked. Essentially, this means selling an asset that isn’t “covered” by another asset. Hence, naked. If you sell a call (or put) option without covering that risk by buying another call (or put), it’s one form of naked selling. There are others.

Trading on margin. If you have to borrow cash from your broker to trade an asset, you’re trading on margin. We’ll just stop there, because this topic is covered in depth in “How to Tame the Margin Beast.”

The Yes-Yes List

The good news? None of this precludes you from using options in your IRA. In fact, you can put several options strategies to work, whether for hedging or speculation. Let’s look at three fundamental strategies.

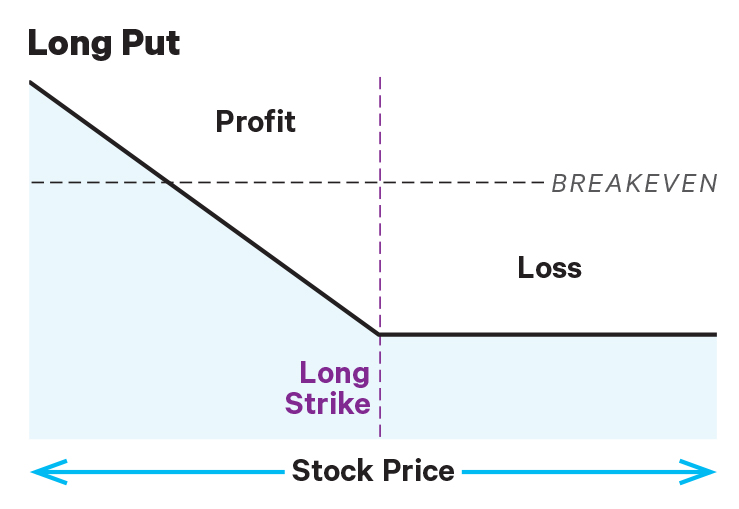

Buying Puts. The first is a hedging strategy that’s used to protect a long stock position from what you might consider an excessive loss. It’s called a “protective put” (see figure 1). As the name suggests, it involves buying a put option—one put option for every 100 shares of stock you own. Typically, it’s an out-of-the-money (OTM) put, meaning it has a strike price below the current stock price.

FIGURE 1: THE LONG PUT. For illustrative purposes only.

Put options are often considered a bearish strategy because they increase in value when a stock price drops. But in this context, the profits generated by the put in a down market are meant to offset, to some degree, the losses incurred by the stock you own. When you buy a put, you could choose a strike that represents the price at which you’d no longer be comfortable holding the stock.

In a worst-case scenario, your losses would be the difference between the price of the stock at the time you bought the protective put and the strike price, plus the cost of the put (including trading costs). Suppose you bought the stock at $320, and you buy the 300-strike put for $5 with 30 days until expiration. Your max loss would be $25 per share, plus any trading costs ($320 stock price – $300 strike price, plus the $5 cost of the put). It’s like putting a short-term floor under your stock.

While the long put provides some temporary protection from a decline in price of the corresponding stock, you do risk the cost of the put position. If the long put position expires worthless, you could lose the entire cost of the put position.

On the positive side, if the stock increases in value, you’ll enjoy those profits, minus the cost of the put (plus trading costs). As long as the stock increases by more than the cost of the put, you’ll have something to show for it.

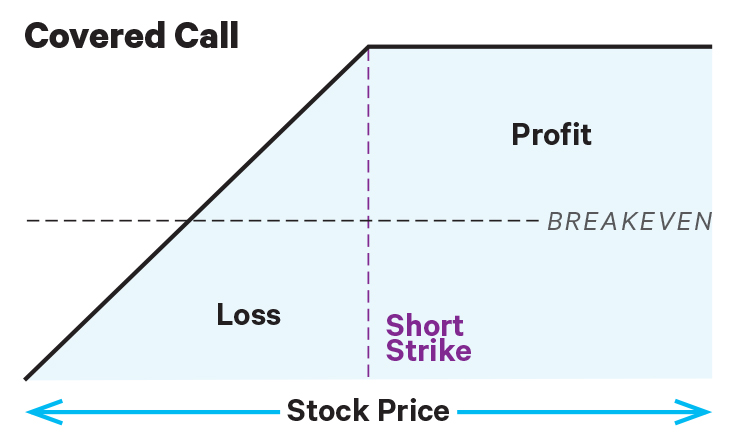

Covered Calls. This strategy is related to the protective put in that it can offer some cushion in a moderately down market by generating income in your IRA. It’s called a “covered call,” and, as you probably guessed, it involves a call option (see figure 2). But this time you’d sell the call—typically one OTM (strike price higher than the current stock price) call for every 100 shares of stock. When you sell a call option on stock you own, it’s not considered a “naked” sale. You get to keep the premium from the sale—cash in your account—and that can help cushion the blow a bit in a down market.

FIGURE 2: THE COVERED CALL. For illustrative purposes only.

At any time prior to or at expiration, if the stock price rises higher than the strike price of your call option, you could be forced to sell your stock at that strike price. This is called “getting assigned” on the option.

Of course, you could attempt to buy back the call if it looks like assignment could happen, then sell another call option at a higher strike price with an expiration that’s further out. This is called “rolling out,” and many option traders use it in an attempt to collect premium over time. Be aware that short options can be assigned at any time up to expiration regardless of the in-the-money amount, and rolling will incur additional transaction costs.

Let’s go back to the example of buying the stock at $320 and assume you can sell the 340-strike call for $5 with 30 days until expiration. If the stock price stays below $340 through expiration, you keep the premium (minus trading costs) and could potentially do it all over again. The more premium you’re able to collect, the bigger the cushion, which can help if or when the stock drops. If you sell the call OTM (meaning the strike price is higher than the prevailing stock price), there’s room for the stock to grow before hitting that strike price.

So, the covered call strategy can limit the upside potential of the underlying stock position, because the stock would likely be called away in the event of a substantial price increase. And any downside protection provided to the underlying stock position is limited to the premium you receive.

If protective puts create a temporary floor under the stock, and covered calls can generate income, how about combining these strategies?

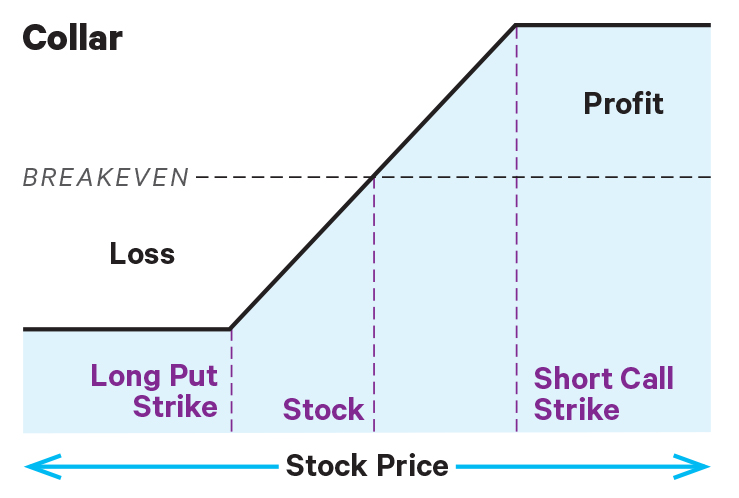

Collar. The third strategy combines the protective put and covered call. It’s called a “collar” (see figure 3). As you may have figured out, the collar position involves the risks of both covered calls and protective puts. For every 100 shares you own that you want to collar, you’d buy one put option and sell one call option.

FIGURE 3: THE COLLAR. For illustrative purposes only.

Let’s use the same sample strikes and prices from the earlier example. If you kept the call until expiration, your $320 stock would be protected below $300, with a “ceiling” of $340 if your covered call gets assigned. The net cost of the collar is zero (you receive $5 for the call, and pay $5 for the put plus trading costs), also called “even money.” You won’t always be able to put the collar together with options premiums that completely offset, but if the call and put strikes are the same distance from the stock price, the premiums should be fairly close. In this example, you have $20 of risk to the downside ($320 – $300 = $20) and a potential profit of $20 ($340 – $320 = $20).

Trade With Caution, Grasshopper

Keep in mind there’s no such thing as getting out of your trade too soon—particularly if it’s in your retirement account. Trading in an IRA is a new concept for many. So treat it like you’d treat anything else you’re learning for the first time.

If you meet your profit target or your stop-loss threshold, you don’t need to hang on all the way to expiration. You can potentially make adjustments by closing the original trade and opening new positions at different strikes and expirations. There are many ways to adjust your trades as stocks climb (or fall). Each strategy we just discussed is protective and speculative by nature. Either way, options give active investors—even in appropriately approved IRA accounts—a bevy of, well, options.

Can’t Short Stock In an IRA?

Consider this. For every 100 shares you’d like to sell short, you could buy two at-the-money (ATM) puts. Each put should theoretically move $0.50 for each $1 drop in the stock. So two puts will give you a similar profit as a falling stock. The more the stock price drops, the more the profit. If you’re wrong, your losses are limited to the total cost of the put options, so it might be a better risk/return scenario than shorting a stock.

WHAT YOU CAN’T DO

- Borrow on margin

- Short stock

- Sell naked options

WHAT YOU CAN DO in an appropriately approved account

- Trade long stock and ETFs

- Trade long options strategies: Long calls and puts, long vertical spreads, long straddles and strangles, long butterflies and iron condors, long calendars

- Trade short (limited-risk) options strategies: Short vertical spreads, short butterflies and condors

"Trading" - Google News

June 29, 2020 at 08:30PM

https://ift.tt/2NHgPiB

The Dos and Don'ts of Trading Options in an IRA - The Ticker Tape

"Trading" - Google News

https://ift.tt/2tBJjTS

https://ift.tt/3djUFhc

Bagikan Berita Ini

0 Response to "The Dos and Don'ts of Trading Options in an IRA - The Ticker Tape"

Post a Comment