Sideways never felt so good. I think. In this era of investing or trading with limited knowledge, and less in the way of corporate guidance than we might be used to, much of what professionals and machines (In 2020, many professionals are machines.) are trying to price in is an optimistic take on at least some recovery based upon the size and scope of those methods already implemented by policy makers to create and maintain liquid conditions, while halting a crisis of broad insolvency prior to that issue reaching a breaking point.

Equity index futures have built on Friday's gains overnight. You can thank the Bank of Japan that decided to go with "unlimited" for a cap on it's current quantitative easing program, while also expanding the scope of corporate debt that the central bank is willing to purchase.

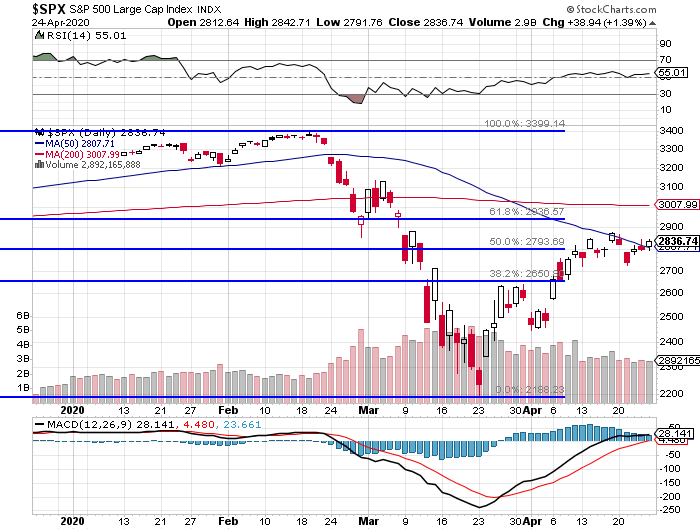

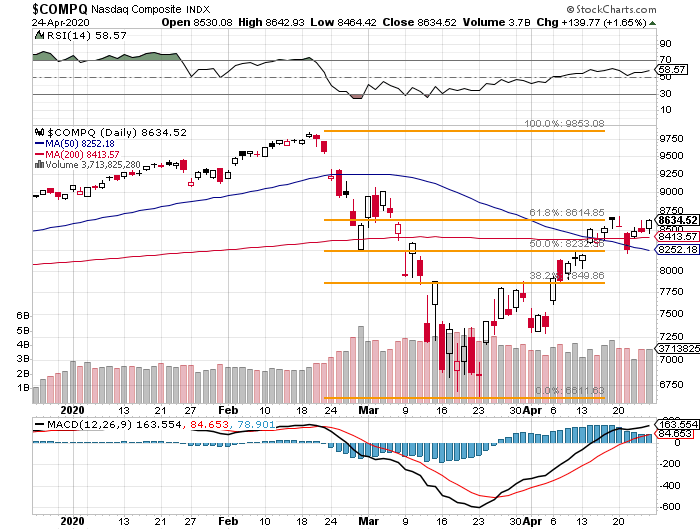

Back home, equity markets remain quite vulnerable, on a day to day basis, really trading sideways for about two weeks. Friday's welcome rally actually strengthened into the close, after Thursday's session had sent up some signs of caution. Trading volume was lighter at both of New York's primary exchanges on Friday from Thursday. That much is true, However, traders need to note that the key levels that we have discussed here, the 50 day SMA of 2807 for the S&P 500...

... and the 200 day SMA for the Nasdaq Composite of 8413 have either been retaken, held, or both as of week's end.

What does that all mean? My take? Sideways allows for basing. Basing is required for stocks to go higher. Can basing and/or resistance be mistaken for each other in real-time? Of course. Is it easy to see a case where equity markets retest the lows of March in May? Just as easy as it is to see these markets in the early stages of a new bull market. No, that is not "my call", you all know that I readily admit that I do not own a functioning crystal ball. What I do have is a willingness to try to adapt to the environment provided. This is something that each and every one of us is capable of. Right now, I still see an uptrend that is intact. Am I lower in cash than I was? Yes. Am I higher in cash than I would be had 2020 gone more normally? Yes.

Risk Versus Reward

This Wednesday, the Bureau of Economic Analysis will release its very first estimate for first quarter U.S. economic growth on a quarter over quarter, annualized, and then seasonally adjusted basis. No matter how much you season this dish, it's going to leave a bitter aftertaste. Expect to see something like -4%, and understand that the economy decreased in size to a far greater degree than that after the first quarter ended. Later on Wednesday, we'll hear from the economic hero of recent months, Fed Chair Jerome Powell who has been as aggressive in the face of adversity as I think any of us could have imagined. Thank goodness the president picked and then did not fire this guy.

As usual, Powell's press conference will likely be what both investors as well as the financial media will focus upon. Perhaps there will be discussion this week on the progress made in keeping open the lines of liquidity, perhaps new action will be taken to plug holes that you and I have not yet even identified. In the end, there will be questions requiring answers that will have to address the size of the Fed's balance sheet from a monetary perspective as well as fiscally, the mass of domestic money supply versus the ability of a smaller economy to carry a greatly increased debt-load on reduced tax receipts.

Yes, this thinking is way ahead. First there is a virus to defeat, and that virus is being given a second chance to grow in certain regions. I do not judge. I can not, as this is not my place, and due to the fact that I live in New York, my understanding of this virus is different than might someone else's be if they live somewhere else, and maybe to them, it seems surreal.

Facts are facts. The economy, in particular... the engines of small business have ground to a halt in the face of the need to take social distancing to higher levels than most folks had ever experienced. The rewards of reopening the economy where it appears that you can are obvious. The risk of a second wave of infections, I think just as obvious. The lack of effective therapeutic treatment after the apparent failure of Hydroxychloroquine to produce positive results, and as the world awaits more news on just how well Gliead's (GILD) Remdesivir might work, makes the effort that much riskier.

Summer Lovin'

On Sunday, Treasury Secretary Steven Mnuchin told Fox News, "I think that as we begin to reopen the economy in May and June, you're going to see the economy really bounce back in July, August, September." I do understand that the secretary, who I think has risen to the occasion, by the way... is being just a bit more optimistic than maybe I would be. That said, I have always tempered my expectations, so I could really enjoy the experience when and if I managed to outperform.

This is the deal. The United States shut down a globalized $22 trillion economy. What will reopen will be a $15 trillion (???) largely domestic economy. This new economy will reopen in a staggered, uneven way, where ultimately there will be necessity to draw in supply chains. That will slow growth and reduce margin, though we now know... just how necessary it is to maintain a domestic industrial base. That is way ahead of what will happen this spring/ summer though. What happens before us is the reopening of a much smaller economy that would through decree and by a broad need to maintain public safety move in baby steps.

Best case... the very beginning of regional restarts allows local economies to take on what looks at the start to be a "V" shape recovery. Some governors may (maybe already have) jumped the gun. This increases risk. Risk of what? We are told by national and local leaders that we are past the apex, that conditions are improving. Well, the slope of that national curve is seeing an impact of the local curves in the states of New York, and New Jersey, in other words, the national epicenter. We still have no real idea how broadly this virus has infected the masses.

What that means to the hamster running circles inside this middle-aged cranium is that there could be an unwelcome situation brewing in areas less capable to handle these situations either on a per-capita basis, or in terms of distances traveled between medical facilities. Now, I did not come up with this on my own. I saw Dartmouth economist David (Danny) Blanchflower (who served with the Bank of England's Monetary Policy Committee during the last financial crisis) post what looks like a reverse square root symbol on social media as an idea for this recovery looks like. Doesn't that make at least some sense?

A bit of a lift-off, because we are coming from an extreme place, with a ton of rocket fuel in the way of what the policy makers have put in place. Then, prior to the economy reaching it's former size... sideways. Why, because not everyone came back in anything close to the same shape they were in prior. Because the virus threw us a few more curveballs. Because a vaccine remains elusive. Because demand never truly resumed at former levels for fossil fuels, or commercial real estate. Because a period of austerity followed this mess, not just at the national and global levels, but at the corporate, state, municipal, and even down to household levels. What has had to be done, indeed had to be done. Even more will have to be done. On the other side of the mountain? Smaller budgets, smaller economies beckon.

Valuation

As of the very latest information published at FactSet, the blended (already reported among the still to report) rate for Q1 earnings growth for the S&P 500 is now -15.8%, as expectations for Q2 now stand at -31.9%. All four quarters of 2020 have now seen significant reductions made to consensus expectations. What this has done has taken where the S&P 500 is currently trading to a 12 month forward looking PE ratio (in aggregate) to 19.1 times. Expensive by any measure, when referenced against a five year average of 16.7 times, or a 10 year average of 15 times even.

Are equities truly expensive though? In this environment? Only a fool would answer this question either way with any kind of certainty. For sure, TINA (there is no alternative) has returned, and this time she may stick around for a very long time. Then there is all of this rocket fuel that we've been speaking and writing about. Does the increased monetary and fiscal help boost the economy on lift-off? Would you bet the farm against this? Even if the economy ends up looking like a reverse square root symbol, does that mean that equities can not end up semi-permanently overvalued in a "historical only" kind of context?

It is very easy in these times to become pessimistic. Very difficult to not let the realities of our times cloud judgement based upon both past experience as well as our own broad lack of depth in anything resembling precedent. The markets will become even more volatile in my opinion, and even more sensitive to headline risk. There will be days that bulls and bears alike will doubt their own judgment. Just do not underestimate the light at the end of tunnel. Sunshine, or a coming train? Decisive either way. Adapt.

Eyes On... PepsiCo

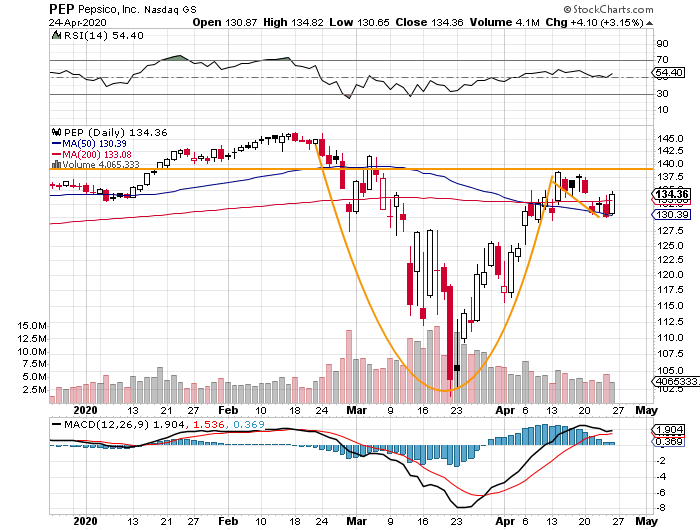

Earnings due in about 24 hours. The chart does show some cause for optimism going into the event.

Readers will note that PepsiCo (PEP) was very strong on Friday, up more than 3%, but on light volume. That said, the strength of that session created by a rebound off of the stock's 50 day SMA, permitted the shares to retake the 200 day SMA as well. Not only this, but as Relative Strength turned up from neutral, as the already attractive looking daily MACD curled away from what would have been a bearish crossover had it (it still might) occurred.

Now, although the numbers posted as well as any guidance offered will certainly take precedence, we have a fully formed cup with handle (I kind of hate cups without handles) with a pivot point just below $138. Just sayin' No sure thing here, but right now am long PEP and I have a $147 price target on the shares. I see a take and hold of that pivot, and I will have to drastically upgrade my price target up into the mid-$160's. Just in case the fates turn against me, I also have a new $125 panic point on this name.

Economics (All Times Eastern)

10:30 - Dallas Fed Manufacturing Index (Apr): Expecting -84, Last -70.

The Fed (All Times Eastern)

Fed Blackout Period.

Today's Earnings Highlights (Consensus EPS Expectations)

Before the Open: (CMS) (.80)

After the Close: (CE) (2.23), (KDP) (.27), (NXPI) (1.40), (PPG) (1.17)

(PepsiCo is a holding in Jim Cramer's Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells PEP? Learn more now.)

"Trading" - Google News

April 27, 2020 at 06:38PM

https://ift.tt/3aEwV5p

Vulnerable Markets, Reopening the Economy, Trading PepsiCo: Market Recon - TheStreet

"Trading" - Google News

https://ift.tt/2tBJjTS

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Vulnerable Markets, Reopening the Economy, Trading PepsiCo: Market Recon - TheStreet"

Post a Comment