Wall Street stocks rallied sharply at the end of a wild week across global markets on Friday, as investors weighed the prospect of rapid interest rate rises by the US Federal Reserve and an upbeat earnings report from Apple.

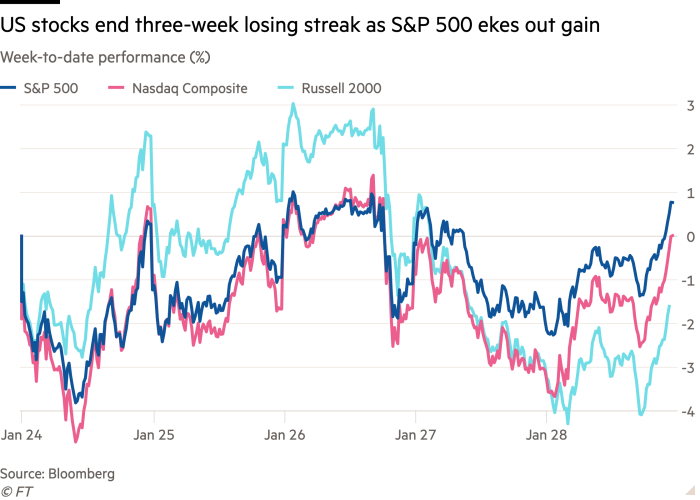

The benchmark US S&P 500 index rose 2.4 per cent as a late-day advance gathered momentum, reversing a drop of as much as 0.8 per cent earlier in the day. The rise was enough to put the index in the green for the week, ending a three-week run of losses.

The Nasdaq Composite index advanced 3 per cent, enough to eke out a marginal gain for the week.

Both indices have swung violently in recent trading sessions, with intraday moves pushing gauges of volatility to their highest levels since October 2020 this week.

The gains on Friday followed a strong quarterly update from Apple, the world’s largest company by market capitalisation, as its shares rose 7 per cent. The iPhone maker also revealed a lighter hit than analysts had forecast from coronavirus-related semiconductor supply chain glitches.

Equity markets, particularly those on Wall Street, have proved volatile this week as investors grappled with a hawkish message from Jay Powell, the Fed chair, following the US central bank’s monetary policy meeting on Wednesday.

Geopolitical tensions as Russian troops gathered at the Ukraine border have also helped to drive the S&P gauge about 7 per cent lower this month. The Nasdaq is down 15 per cent from its November record high.

“Two factors explain this difficult period for equity markets,” said Christophe Donay, chief strategist at Pictet Wealth Management. “Tensions over Russia and Ukraine have contributed perhaps a third of the correction and the rest is the Fed.”

Monetary policy concerns remained top of mind for investors. Powell on Wednesday signalled the central bank was ready to raise rates from record lows to tackle soaring inflation. Futures markets have priced in about five quarter-point interest rate rises this year, starting in March.

Higher interest rates increase companies’ borrowing costs and lower the present value of forecast profits in investors’ models.

The Fed’s hawkish turn has therefore challenged some investors to re-engineer portfolios, given that as recently as mid-September pricing in overnight funding markets implied the central bank would raise rates just once this year.

“This is a huge regime change,” said Gergely Majoros, investment committee member at fund manager Carmignac. “It is difficult to hold convictions.”

Yields on US Treasuries, which have been under selling pressure as expectations of higher interest rates and persistent inflation reduced the appeal of fixed income-paying securities, ticked down on Friday as the price of the debt rose.

Core personal consumption expenditure data on Friday showed the Fed’s favoured measure of inflation rose at an annual rate of 4.9 per cent in December, slightly outpacing economists’ forecasts.

“Markets are adjusting to what is a new normal, and that the Fed will have some catching up to do in the months ahead,” said Edward Jones senior financial strategist Mona Mahajan. “We think they will move pretty aggressively, especially in the first few months of their tightening cycle.”

The yield on the two-year Treasury note, which closely tracks monetary policy expectations, fell 0.02 percentage points to 1.17 per cent. The 10-year yield dipped 0.01 percentage points to 1.79 per cent, though still up sharply from the end of 2021.

The dollar index, which measures the US currency against six others, was flat after climbing to its highest point in almost 18 months on Thursday.

European markets fell broadly on Friday, with the regional Stoxx 600 index down 1 per cent. In Asia, Hong Kong’s Hang Seng index fell 1.1 per cent while Tokyo’s exporter-heavy Nikkei 225 added 2.1 per cent.

Additional reporting by Tommy Stubbington

"Trading" - Google News

January 29, 2022 at 04:12AM

https://ift.tt/3g6eZWA

US stocks rebound in volatile trading as wild week draws to a close - Financial Times

"Trading" - Google News

https://ift.tt/2tBJjTS

https://bit.ly/3AO91mP

Bagikan Berita Ini

0 Response to "US stocks rebound in volatile trading as wild week draws to a close - Financial Times"

Post a Comment