The world seems like a scary place these days, doesn't it? So does the stock market. I mean, if you are a chart reader and you look at the chart of Nasdaq, all you see is lower highs for the last four months, right? Or do you realize that the S&P 500 had its lowest Friday close since June this week? Scary stuff.

Charts are scary and the news is scary. I will even add to the list by noting some scary statistics. For example, the CBOE Volatility Index hasn't gotten jumpy yet but rather has spent an awful lot of time chopping about. Or that the various indexes all have their longer term, 200-day moving average lines flat or rolling over. Or that we have been oversold for nearly 10 days now and while we did rally, much of the time has been spent chopping rather than rallying.

Yet I find when the world and the market seem so scary, I like to see if there are any green shoots for us to hang our hats on. So let's explore.

The aforementioned Oscillators are not at the lows of two weeks ago, let alone the January low. That shows that despite the drooping in the market, the momentum, for now at least, hasn't been terribly forceful on the downside.

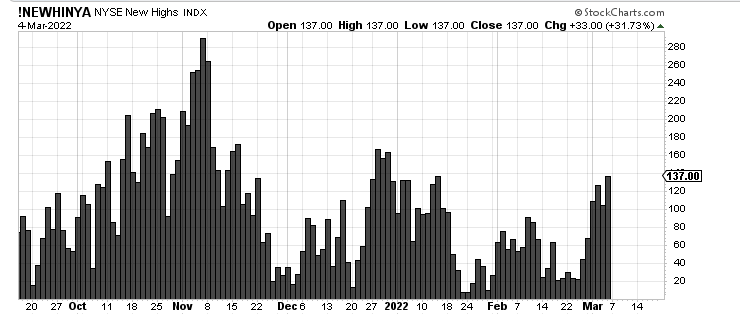

The number of stocks making new lows is still not where it was nearly two weeks ago. And on the New York Stock Exchange, the new highs are the most we've seen in nearly two months.

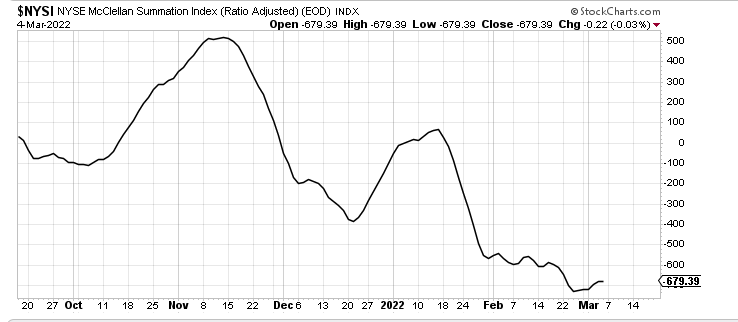

One of the biggest surprises to me is that the McClellan Summation Index didn't turn down last week. Oh give us one day of crummy breadth and it will, but at least for now, it hasn't.

But the biggest surprise is the Transports. Considering the price of oil, the Transports should be dying, plunging, downright awful, right? So what the heck are the Transports doing up about 6% from the (closing) low two weeks ago? More than that, they are trading higher than their January close.

The Transports like Nasdaq, peaked back in November so I find it quite curious that they have not collapsed since Russia invaded Ukraine. Now I grant you there is an awful lot of resistance overhead, starting at 15,750 but again, I think this is one index to watch closely.

We can understand the flight to quality in the utilities, but up 15% in two weeks in what promises to be a rising rate environment? They have eked out a higher high - an all time high. I do think there is resistance at that blue line (call it 990-1,000) but that move over the last two weeks is impressive.

And of course we know sentiment is terrible. It's extreme in some places but only 'almost' extreme in others. The extreme is in the Investors Intelligence survey where the bears outnumber the bulls for the first time in two years (since spring 2020). The almost extreme is in the National Association of Active Investment Managers where they have reduced their exposure to the market to 30, the lowest since it was 10 in March 2020. And it is a far cry from the 100+ it was in November.

I still think we should have another rally attempt this week. But I also still think this is a trading market, not one to get comfortable in.

"Trading" - Google News

March 07, 2022 at 06:00PM

https://ift.tt/9a6Sy7A

Another Rally Coming in This Trading Market - RealMoney

"Trading" - Google News

https://ift.tt/XwP38zV

https://ift.tt/JCtFVdY

Bagikan Berita Ini

0 Response to "Another Rally Coming in This Trading Market - RealMoney"

Post a Comment